What Iran announced

In the catalog of the state exporter Mindex an offer has appeared to sell military equipment — from Shahed drones to Emad ballistic missiles and Shahid Soleimani-class ships — with payment in cryptocurrency, by barter, or in Iranian rials. The Financial Times writes about this in detail, citing the company’s public catalog.

Why this matters for you and for Ukraine’s security

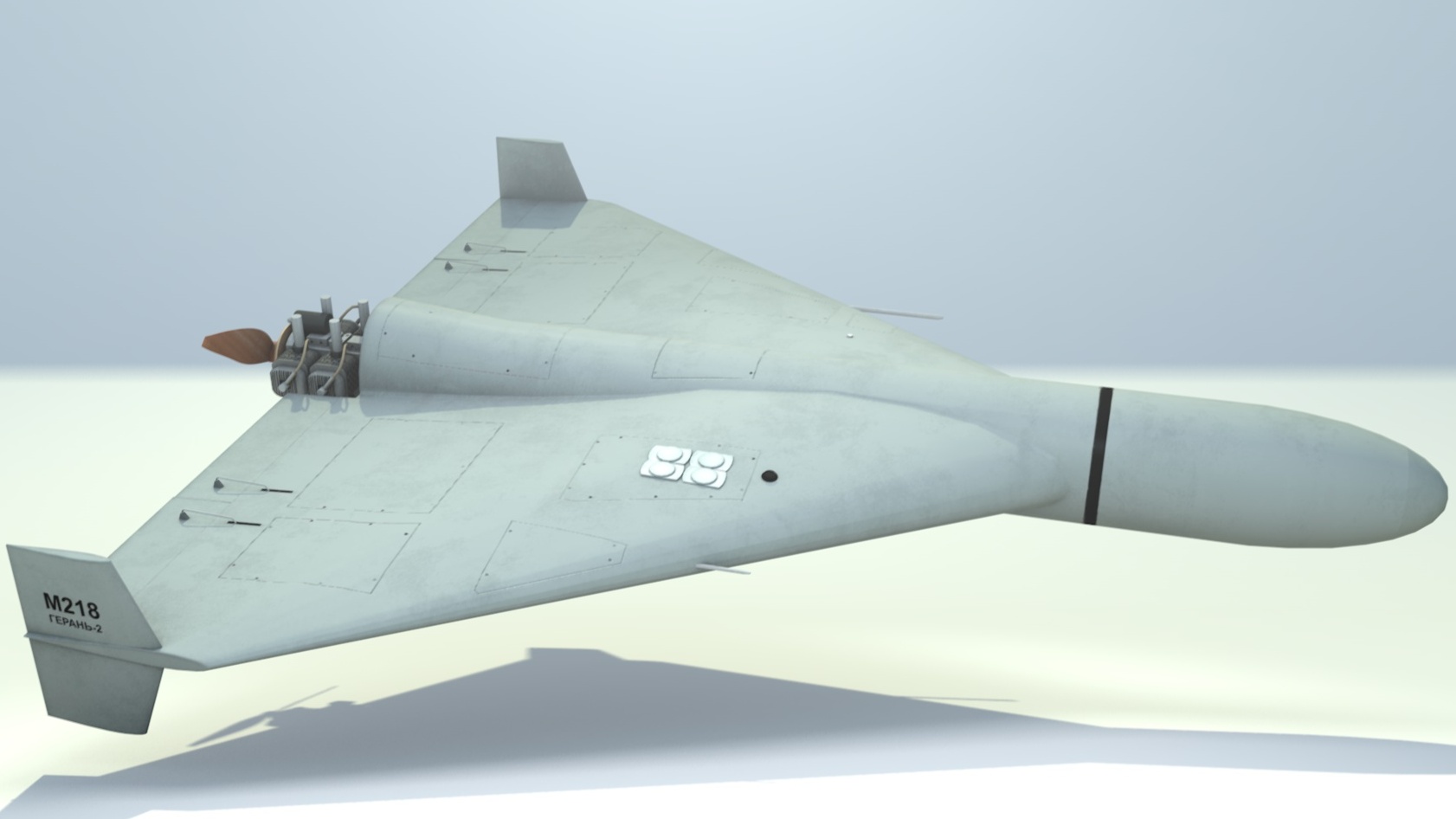

In short: this makes sanctions-evading schemes more extensive and more public. If a state openly allows cryptocurrency payments for strategic armaments, control mechanisms that rely on banking channels and customs checks lose their effectiveness. For Ukraine, this means an increased risk that combat systems will end up in the hands of aggressors or their intermediaries, who are already using Iranian UAVs against our infrastructure.

"This is one of the first known cases in which a state has publicly declared its willingness to accept cryptocurrency as payment for the export of strategic military equipment."

— Financial Times

Context: sanctions and shadow finance

In September 2025 the UN reinstated an embargo on arms shipments to Iran. That same month the US Department of the Treasury imposed sanctions on individuals linked to the Islamic Revolutionary Guard Corps over a "shadow banking" network that used cryptocurrencies for transactions. The combination of Mindex’s public offer and already-known shadow payment schemes creates a real operational threat to the international sanctions regime.

How the mechanism works — simply

1) The buyer concludes a deal through intermediary networks. 2) Payment is made in cryptocurrency to addresses associated with the shadow-banking networks, or a barter scheme is initiated. 3) Equipment is delivered through complex logistical chains, sometimes with intermediate stops in third countries. Such routes are harder to intercept than classic bank transfers — especially if a state apparatus is coordinating the shipments.

What partners and Ukraine can do

Experts and analytical groups point to three practical steps: strengthen blockchain monitoring for transaction characteristics that indicate arms trade; coordinate sanctions lists and mechanisms to "freeze" addresses; and increase operational support for air defense and counter-drone systems to reduce the impact of a potential new influx of Iran-oriented equipment. For Ukraine it is also important to document and publicly demonstrate links between buyers and the end strikes on civilian infrastructure — this increases political pressure on intermediary countries.

Conclusion

Iran’s public offer to accept cryptocurrency for defense products changes the rules of the game in the arms market. This is not just a technical issue of sanctions evasion — it is a challenge for international coordination and for Ukraine’s defense capacity. Whether partners can quickly close these new channels is a question on which the speed at which potential threats turn into real problems at the front depends.