What happened

The Estonian banking group Iute Group announced plans to enter the Ukrainian market by creating a new digital bank on the basis of the bankrupt RVS Bank. According to the group's press service, the company expects to receive the National Bank of Ukraine's approval to acquire the entity created in place of RVS Bank — PJSC "Transitional Bank 'Iute Bank'" — by the end of January. The new bank will operate under the IuteBank brand.

"Completing this deal will allow us to enter the Ukrainian market and add to the group the first fully digital bank that will operate under our brand and will have no 'legacy' of past systems or practices. IuteBank is being built from scratch: we are buying a transitional structure with a banking license, carefully selected assets and corresponding deposit liabilities that originate from RWS Bank"

— Tarmo Sild, CEO of Iute Group

Deal details and financial framework

Iute mentions a small initial balance for the bank — up to 10 million euros. At the same time, the group has set an internal investment threshold for Ukraine at 15 million euros until certain performance and profitability indicators are met and the war is over. The company forecasts that the expected net loss of the bank in 2026 will not exceed 3 million euros.

Personnel and operational strategy

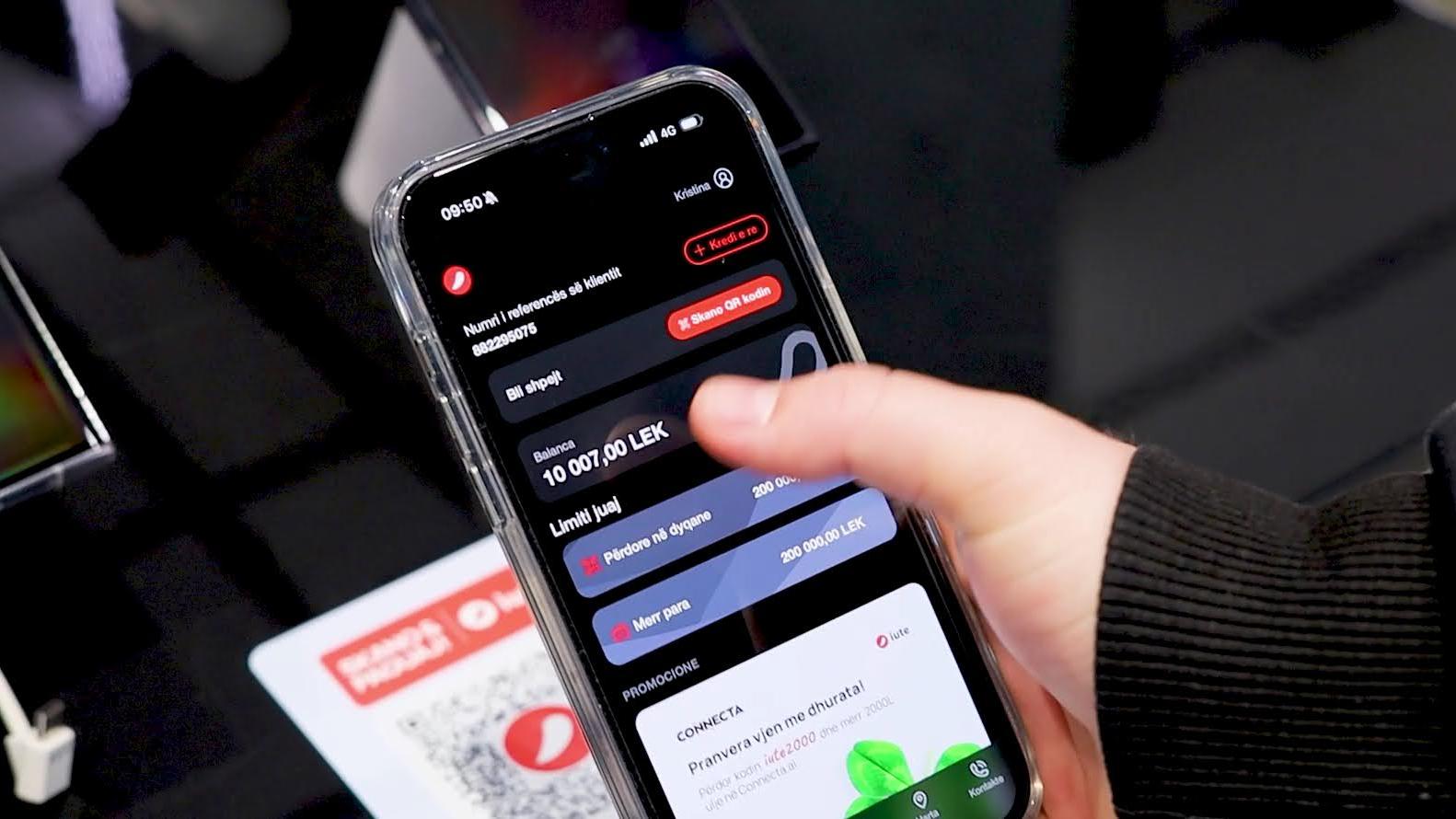

IuteBank will be led by Ukrainian banker Artur Muravytsky, who has more than 22 years of experience in the financial sector (former deputy chairman of the board of TAScombank and former chairman of the board of Finans Bank). According to him, the first year will be dedicated to launching the digital app and key products, followed by scaling.

"During the first year the focus will be on launching the digital app and key financial products with the start of customer acquisition. The next stage will focus on scaling the business — increasing volumes and expanding the product offering"

— Artur Muravytsky, incoming head of IuteBank

Context: what happened with RVS Bank

RVS Bank, created in 2015 on the basis of the bankrupt Omega Bank, was controlled by the UBG group associated with former Member of Parliament Ruslan Demchak. As of early 2025, 99% of the shares belonged to Oleksandr Stetsiuk and 1% to Demchak's daughter, Kateryna. RVS Bank's market share was minimal — about 0.04%.

According to financial statements, in the nine months of 2025 the institution suffered a loss of more than UAH 200 million, its equity nearly halved, and assets fell from UAH 4.51 billion to UAH 1.51 billion. Problems began to emerge at the end of 2024, when the bank rapidly lost its loan and deposit portfolios.

What this means for the market and for citizens

First, the arrival of a foreign investor in the digital banking segment is a vote of confidence in the potential of the Ukrainian financial market, even under wartime conditions. Second, the model of launching via a transitional structure with a license makes it possible to avoid inheriting problematic assets and start with a clean balance sheet, but it also limits the scale of the initial expansion — up to 10 million euros of starting capital will not create an immediate systemic threat, but nor will it change the market structure for a long time.

Analysts note that such a gradual approach is an indicator of a cautious investor strategy, but success will depend on the speed of obtaining the NBU's approval, the quality of the transferred assets and the new team's ability to attract customers in a competitive digital environment.

Risks and questions

Main risks: potential hidden non-performing loans in the transitional portfolio, slow customer trust in the brand, and geopolitical and macroeconomic factors that affect investors' plans. Regulatory scrutiny and transparent conditions for the transfer of assets remain key safeguards for depositors and for the system as a whole.

Conclusion

The launch of IuteBank is primarily a pragmatic move by an investor who views the Ukrainian market as promising even in difficult conditions. For society, it signals that foreign capital is ready to invest in the digitalization of financial services, but success will depend on the regulator, management quality and real market demand. Whether Iute will turn a small start into sustained success is a question for the next 12–24 months.