Reaction in Davos

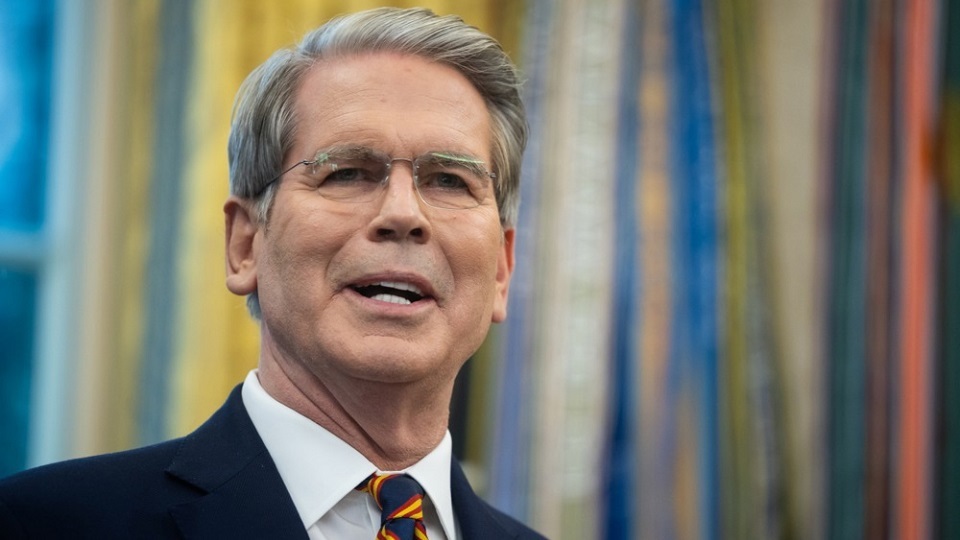

U.S. Treasury Secretary Scott Bessent reacted sharply to the statement by the Danish pension fund AkademikerPension about selling U.S. Treasury bonds, CNBC reports. Speaking to reporters in Davos, he dismissed the move as insignificant for the market.

"Denmark's investments in U.S. Treasury bonds, like Denmark itself, mean nothing"

— Scott Bessent, U.S. Treasury Secretary

According to Bessent, the amount is less than $100 million — a sum negligible for the Treasuries market. He also noted that the U.S. is recording a record inflow of foreign investment into its government bonds.

Context: where the idea of U.S. "dependence" came from

The trigger for the wave of speculation was a Deutsche Bank research note dated January 18, which highlighted vulnerabilities in the U.S. funding model. As the outlet quoted, the note said:

"The U.S. has one key weakness: it depends on others to finance its obligations"

— George Saravelos, global head of FX research, Deutsche Bank (from the January 18 note)

However, Bessent said that the CEO of Deutsche Bank personally called to say that the bank does not endorse the interpretations of that research report that spread in the media.

Politics, rhetoric and markets

Against the backdrop of the finance discussion a geopolitical note also emerged: Bessent made a pointed statement about Greenland, urging allies to recognize the strategic importance of the island. In the media this echoes political moves — on January 17, 2026 former President Trump announced the imposition of tariffs against U.S. allies over the Greenland issue.

It is symptomatic that a threat to the market often comes not from single transactions but from a growing narrative: if analysts and politicians create the impression that allies will stop buying Treasuries, this can push up risk premia and borrowing rates.

What this means for Ukraine

For Ukraine, the stability of the U.S. Treasury market is not an abstraction. It determines the cost of borrowing globally and partners' willingness to finance defense and reconstruction. Even if the actual volume of sales is tiny, what matters more is whether this rhetoric will undermine trust among allies.

Conclusion: what to watch next

Rhetorical flares and analytical sensations can affect market expectations more than small current transactions. Experts note that for now capital flows into Treasuries remain strong, but risks rise if geopolitical tension intensifies. The ball is now in the politicians' and financiers' court: will facts calm things down, or will the narrative build in a way that actually changes financial conditions?